Self Managed Super Fund Property Valuations

“At Mason’s we do three things,

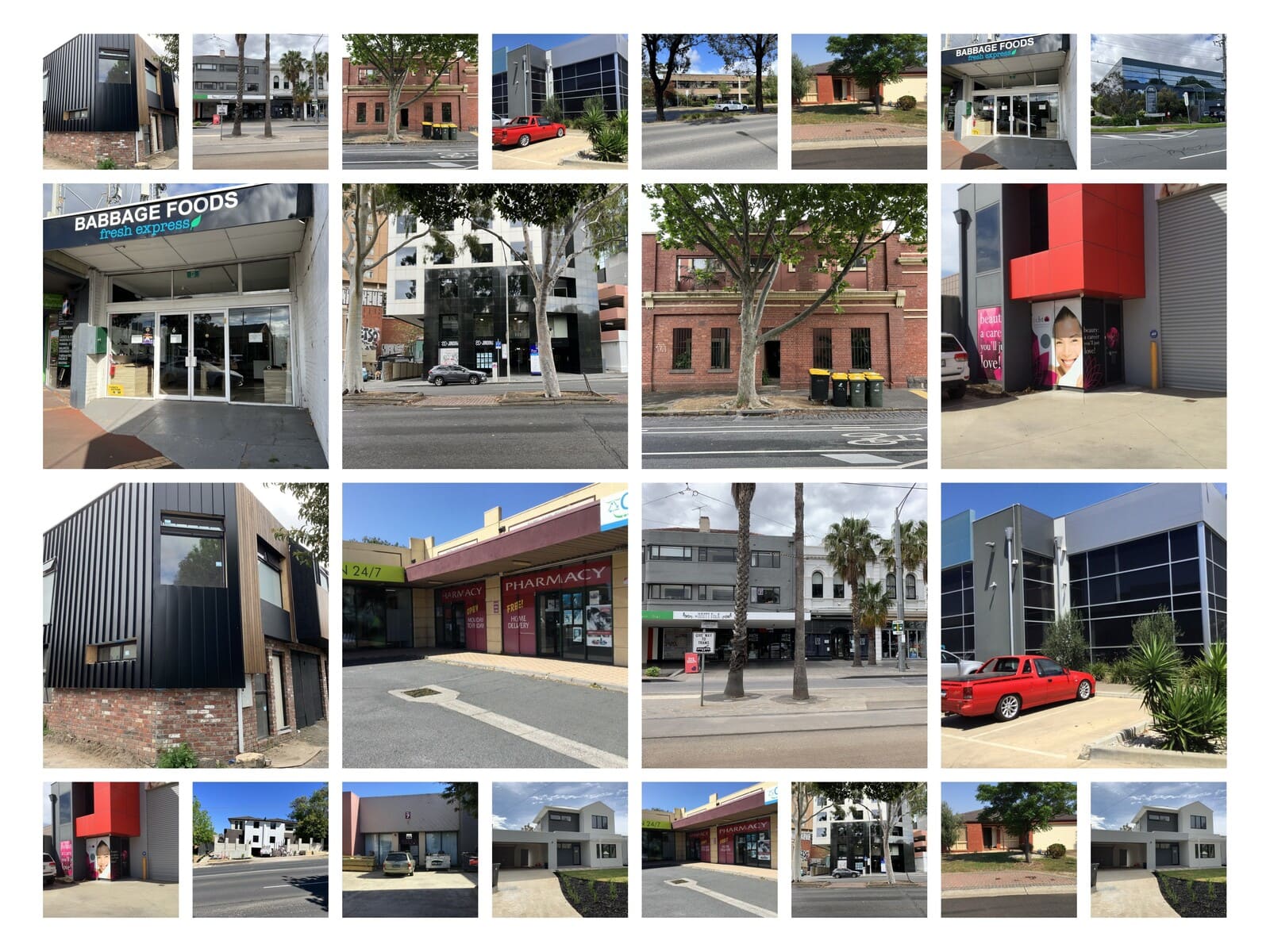

We provide high quality property valuations for residential, commercial, retail and industrial properties;

We provide property valuations within metropolitan Melbourne; and

Our valuation fees are competitive and we provide value for money for our customers”

Chris Mason – AAPI

Certified Practising/Sworn Valuer

Owner

The ATO has clarified the evidence that is required to support real property valuations within SMSF’s. SMSF regulations, suggests that assets must be valued at market value in an SMSF’s accounts and financial statements each year. SMSF auditors need to be in possession of sufficient appropriate audit evidence to support the value of a fund’s investments.

It’s worth reiterating that in 2018, the most common contravention identified by auditors and referred to ASIC for assets being held within SMSF’s was about the inaccuracies and poor reporting of valuations. Before a change to regulations in July 2012, the compliance burden was certainly less onerous; as fund assets were only required to be valued every three years.

It is a legal requirement that all SMSF’s record and report all assets at true market value. A failure to report assets at market value or misrepresenting the value of assets can have compliance consequences for SMSF trustees.

By reporting market value fairly an SMSF can provide an accurate representation of the fund’s value and importantly each member’s interest in the fund. This ensures that all financial reports are meaningful and can be relied up when making important decisions.

In October 2020, the ATO updated its website clarifying the objective and supportable evidence needed to support real property valuations. A trustee should consider an external valuation where the property represents a significant proportion of the fund’s value and they should be updated regularly as events and economic events change.

It is the trustee’s responsibility to provide their auditor with the documents that are requested to support the market valuation of SMSF assets, including real property.

What sort of report will you provide ?

In most cases we would prepare a desktop assessment completed by one of our qualified valuation professionals. We will confirm the details of the property to be valued and then rely upon real-time sales and leasing data that ensures an accurate and timely property assessment. Our accurate assessment of value, assists a SMSF Trustee in accurately reporting market value of the SMSF asset, based on objective and supportable data utilising the appropriate methodology.

Why is an assessment required?

All SMSFs are required to provide a market valuation of fund assets as at the 30 June. In accordance with ATO requirements, SMSFs are audited on an annual basis. As such, it is best practice to ensure that you are relying on current and relevant information to assist with preparing the fund’s financial statements.

How often is an assessment required?

To comply with relevant super law the market value of an asset is required to be reported by the trustee on an annual basis at 30 June each year.

SMSF Fee Structure

Residential Property

|

Asset Value |

Assessment Cost |

Tenancy |

|

For a property worth up to $1.5 Million |

*$330 (Incl GST) |

Single residential property |

|

For a property worth over $1.5 Million |

Request a quote |

Single residential property |

Commercial / Retail / Industrial Property

|

Asset Value |

Assessment Cost |

Tenancy |

|

For a property worth up to $1.0 Million |

*$660 (Incl GST) |

Up to two tenants |

|

For a property worth between $1.0 and $3.0 Million |

*$880 (Incl GST) |

Up to two tenants |

|

For a property worth over $3.0 Million |

Request a quote |

The above pricing is based upon a desktop property assessment (only).

For a variety of reasons many residential and commercial properties can be fairly specialised assets and therefore these types of properties will require an initial full valuation in order to accurately describe their attributes and to provide the most accurate valuation.

For other more specialized property types, such as accommodation homes, aged care facilities, caravan parks, medical centres, shopping centres would also require a full valuation.